-

Checkout my iOS App -

Recent Posts

Recent Comments

- charvey on Bundesbank Special Ops Group (Deutsche Mark Reappears?)

- Lars Erik Morin on Bundesbank Special Ops Group (Deutsche Mark Reappears?)

- Austin Kairnes on Three intro videos on Bitcoin

- Johnd269 on The Last Man Standing

- Johna689 on QE Won’t Work This Time

Archives

- April 2020

- January 2015

- August 2014

- July 2014

- June 2014

- April 2014

- May 2013

- November 2012

- October 2012

- September 2012

- July 2012

- May 2012

- April 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- November 2010

- October 2010

- September 2010

- July 2010

- May 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

Categories

Meta

Category Archives: Finance

CFOs: Lower Rates via QE3 Will Not Spur Corporate Investment

I hope members of the FOMC will read this before their meeting on Thursday. The Duke-CFO Survey, released on September 11, 2012, provides sharp, new evidence that QE3 will not stimulate economic growth. CFOs clearly tell us (647 of 667 … Continue reading

Posted in Finance

Tagged Corporate Investment, Duke-CFO Survey, FOMC, Monetary Policy, QE3, Quantitative Easing, stimulus

Leave a comment

QE Won’t Work This Time

There are two upcoming FOMC meetings: July 31-August 1, 2012 and September 12-13, 2012. With high likelihood, we will see another round of Quantitative Easing – or QE. Economists are split as to whether there would be any real benefit … Continue reading

Posted in Finance

Tagged Corporate Investment, Cost of Capital, Duke-CFO Survey, QE, Quantitative Easing

4 Comments

Wrong time, wrong place for floating rate debt

Testifying before Congress back in 1993, when interest rates were 7.5%, I advocated shifting some of the Federal debt to floating rate debt. If the Treasury had shifted half of the debt to floating rate at that time, they would … Continue reading

Confronting Global Risks

I am doing a live Webinar on April 11, 2012 at 11:00am ET. It is called Confronting Global Risks. There is a preparatory video that is available here. The live session will take your questions. The basic topics are: I … Continue reading

Posted in Finance

Tagged debt to GDP, downside risk, Eurozone breakdown, global risk, Iran risk, Stress Tests

Leave a comment

Treating the Symptoms

A massive €530 billion liquidity injection occurred in Europe today in the form of LTRO. This helicopter drop does not solve the Eurozone’s problems: it merely delays them. The ECB is treating the symptoms not the disease.

New videos posted

I have just posted a number of videos that deal with current global macro events. They can be viewed on the gardenofecon youtube channel here. Will the austerity measures in Greece lead to a breakdown in civil society that breaks … Continue reading

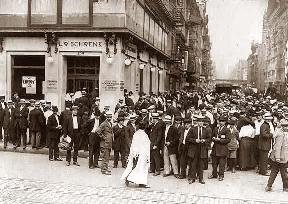

The Run on Europe

There is a lull in negative news from Europe. However, it is short lived. There are four facts that are very important to understand: Most European banks are insolvent The ECB is massively monetizing to keep the system operational Germany … Continue reading

Seven new videos posted

I have posted seven new videos to https://www.youtube.com/gardenofecon Topics include: • What do you think of the announcement from the EU about a fiscal compact? • Is it a big deal that the U.K. is not in the agreement? • … Continue reading

The Last Man Standing

Which is a greater force driving volatility: uncertainty about whether the U.S. can get its budget act together or Europe’s future? I would argue that Europe poses a much greater risk — and it is less understood in U.S. markets. … Continue reading

Posted in Finance

Tagged Article 123, Bundesbank, Campbell Harvey, ECB, EFSF, ESM, Eurozone, Treaty of Lisbon

6 Comments

6 New Videos Posted

You can access the videos at my youtube channel: https://www.youtube.com/gardenofecon The questions being answered are: 1. European debt crisis: a. What are the implications for the long term viability of the Euro? b. What is your perspective on the Greece austerity … Continue reading